Demand, Policy, and Innovation: Shaping the Growing Global Residential Energy Storage Market

-

Company News

-

2025-03-03

-

Dyness

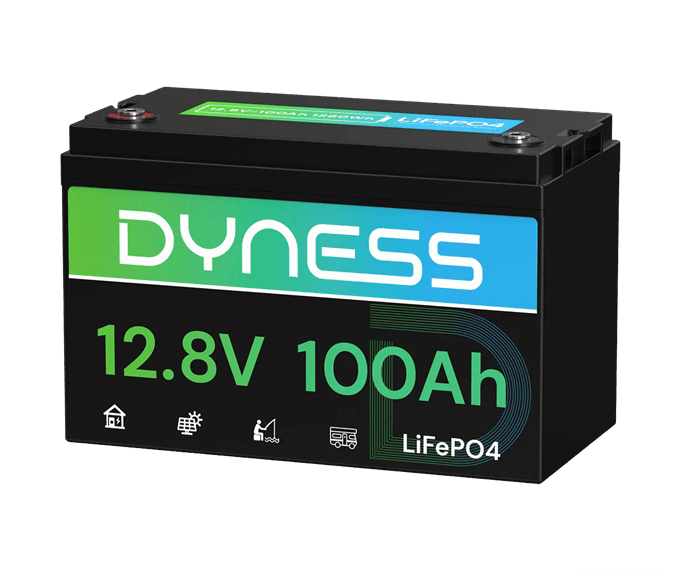

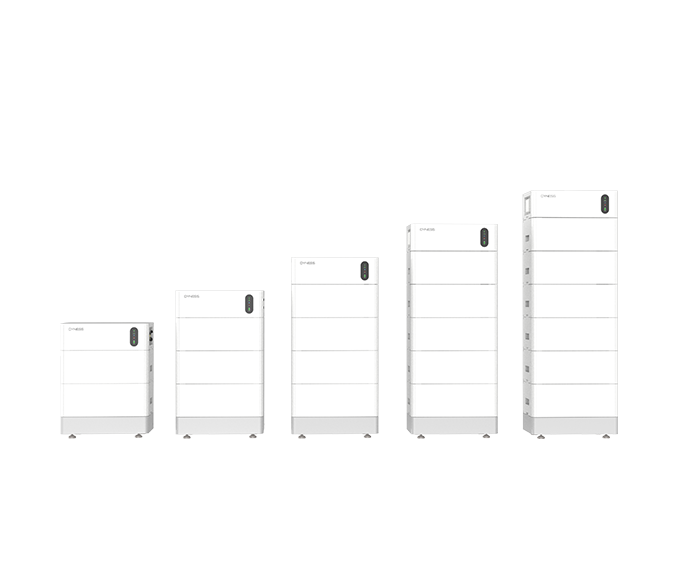

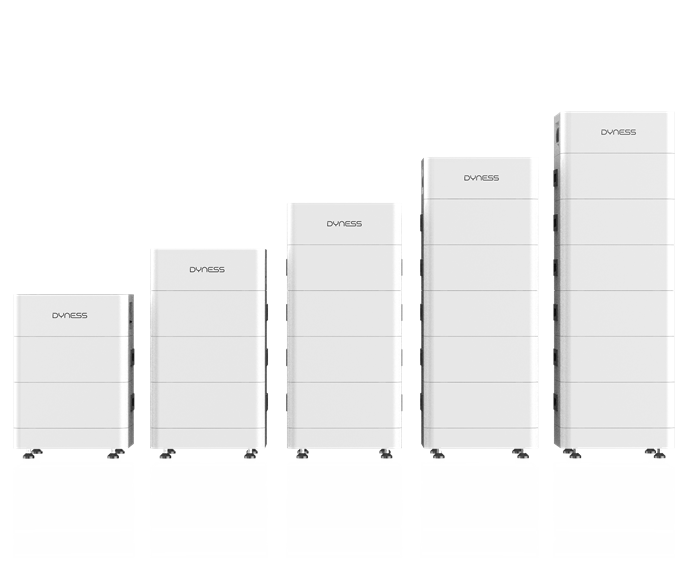

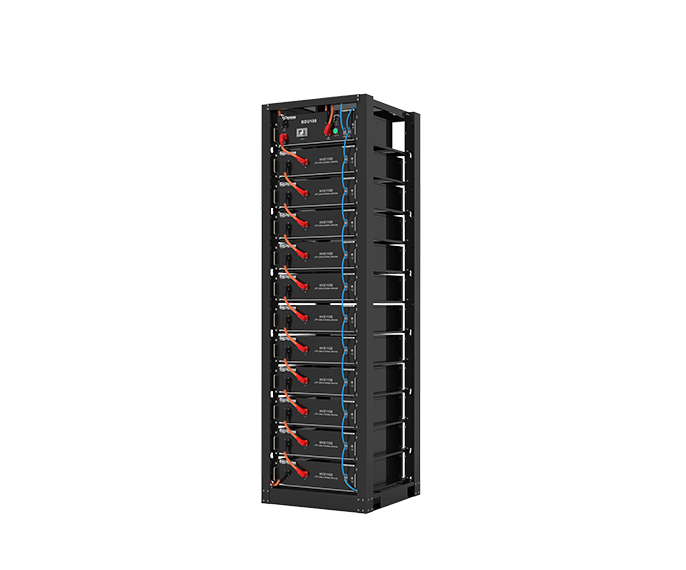

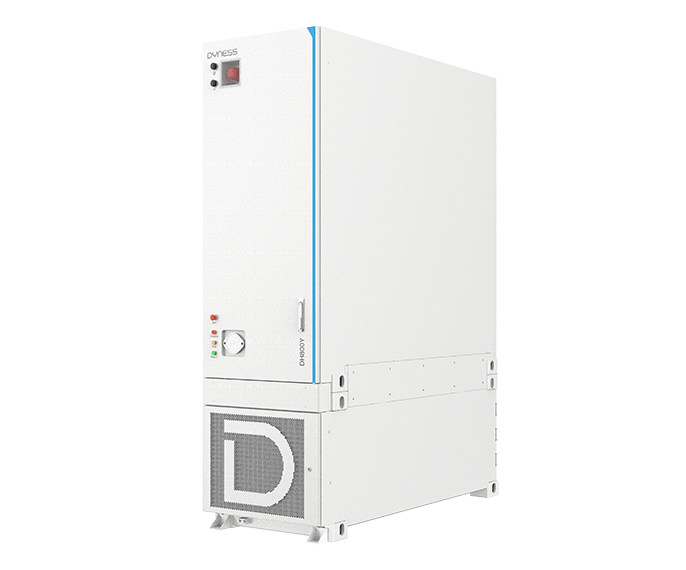

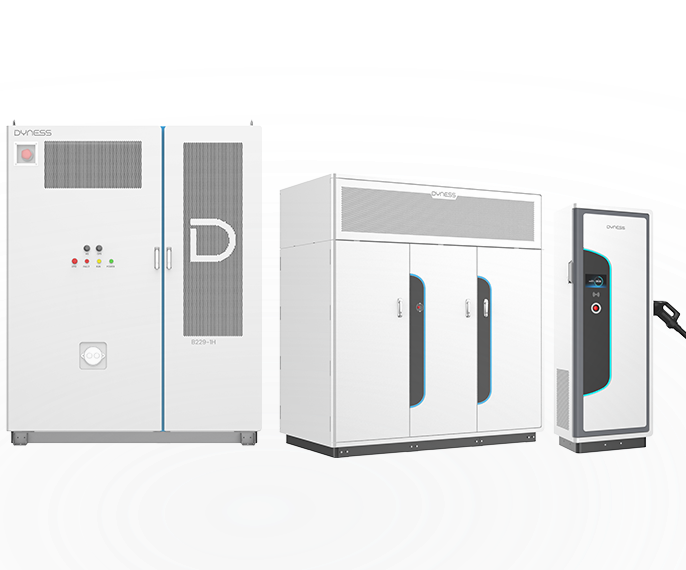

Currently, Dyness owns a comprehensive product portfolio catering to varying user needs in the residential sector, providing powerfulness in all facets of application, design, safety, and user experience. Whether it is market-mature products like Tower and Tower Pro series, or new household solutions such as Powerbox G2 and Powerbrick launched in 2024, Dyness is always moving towards a sustainable future with innovative steps.

At the commencement of 2025, the planet witnessed yet another record-breaking heatwave, with the average January temperature for 2025 once again surpassing the previous record set for the same period in 2024. This signifies the hottest January on record, a phenomenon that underscores the severity of the ongoing climate crisis. The preceding year had been marked by a succession of extreme weather events, which had exerted considerable pressure on people's lives and business operations across the globe. In light of these challenges, the need for resilient electricity systems, flexible energy storage backup solutions, and cost-effective energy efficiency has become paramount.

The renewables dominate the electricity age

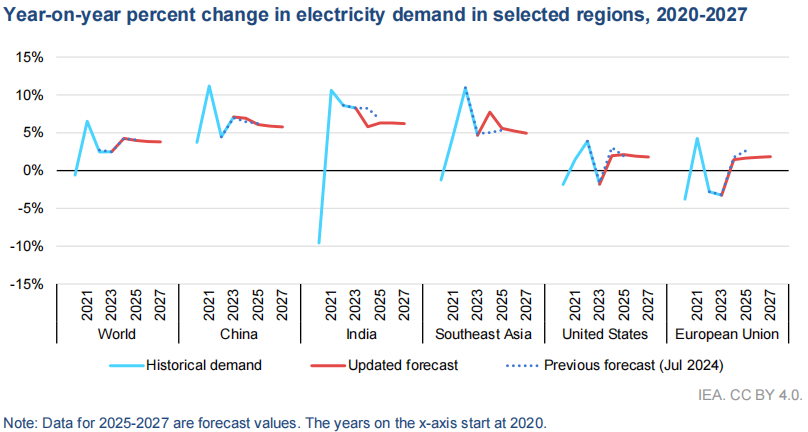

The transition to Net Zero Carbon Emissions and the sustainable energy system is predicated on the rapid deployment of renewables, including solar photovoltaics, which has resulted in significant emission reductions in electricity generation. The International Energy Agency (IEA) has projected that the increase in electricity consumption through 2027 will average around 4% annually, driven by growing use in industry, air conditioning, electrification, and data centers. The majority of this additional demand is expected to come from emerging and developing economies, which account for 85% of the demand growth, with China contributing significantly to this increase.

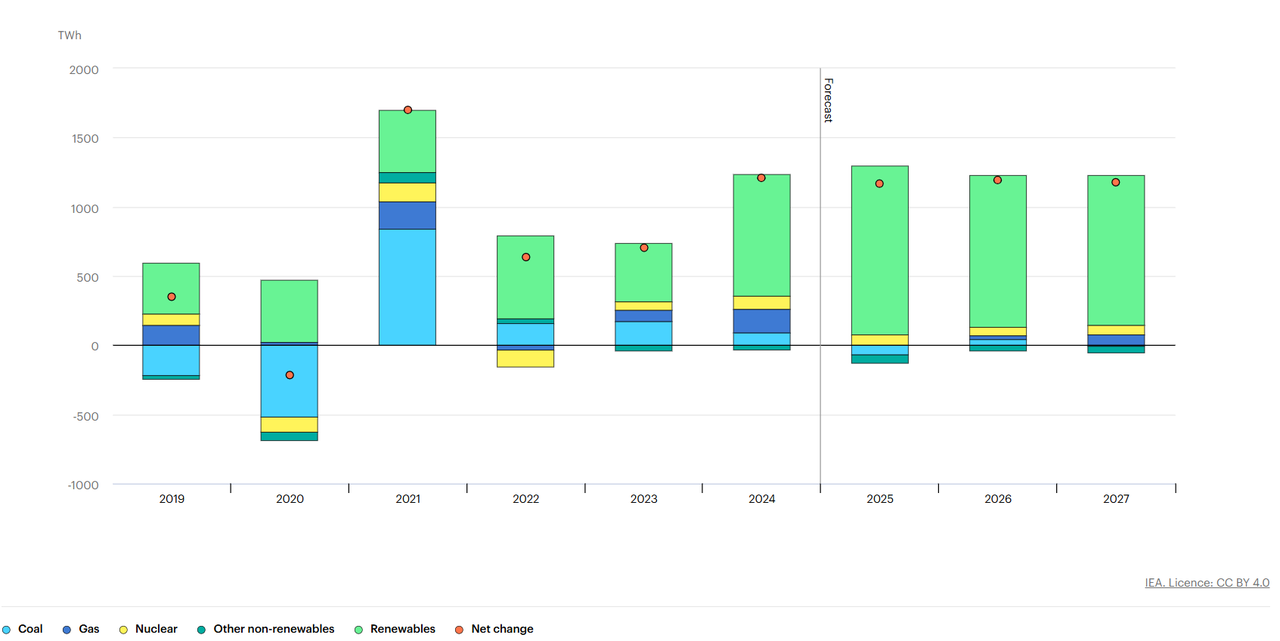

It is reported that China's electricity consumption rose by 7% in 2024 and is expected to grow by an average of around 6% through 2027, primarily driven by the industrial sector. Also, the United States is predicted to experience a substantial surge in electricity demand, with projections indicating that it will reach the equivalent of California's current power consumption nationwide by 2027. In contrast, Europe's electricity demand growth is expected to be more moderate, with forecasts indicating a return to 2021 levels by 2027, following significant declines in 2022 and 2023 that were triggered by the energy crisis. The International Energy Agency (IEA) has also forecasted that the growth in low-emission sources, primarily renewables and nuclear, will collectively meet all the growth in global electricity demand over the next three years. In particular, it is predicted that solar PV generation will account for approximately 50% of the global electricity demand growth through 2027, driven by ongoing cost reductions and policy support. Concurrently, natural disaster events impose heightened demands on power system stability and resilience. These include winter storms in the United States, hurricanes in the Atlantic, and blackouts caused by extreme weather in Brazil and Australia, as well as droughts reducing hydropower in Ecuador, Colombia, and Mexico.

Year-on-year global change in electricity generation by source, 2019-2027, IEA

The year of 2024: the market enters a cooler period but potential remains

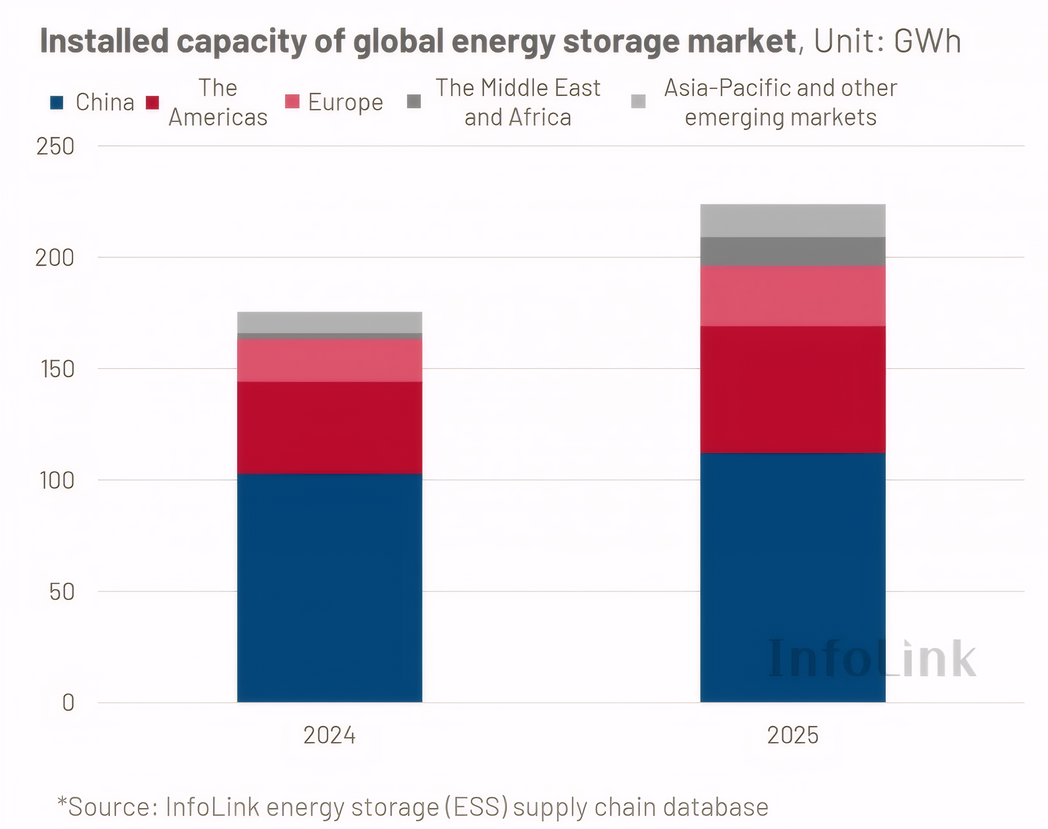

Energy storage has been identified as a pivotal component in ensuring the stability and flexibility of the electricity system, experiencing significant growth in recent years. Notably, the global residential energy storage market, particularly in Europe, has undergone a period of sustained development following a substantial expansion from 2022 to 2023. According to the tracking conducted by EESA, the global residential energy storage is expected to reach 17.8GWh in 2024, which is essentially equivalent to the 17.5GWh new installations recorded in 2023.

It is reported that Europe remains the predominant market for global household energy storage installation, with new installations in Europe projected to reach 11.3GWh in 2024, accounting for 63% of the global total, representing a 6% decrease compared with 2023. The United States is the world's second-largest household energy storage market, with projections indicating that additions will reach 2.1GWh in the entire year of 2024, accounting for a global share of 12% and marking a 2% increase compared with 2023. Japan, Australia, and South Africa are projected to have new installations reaching approximately 1GWh each, respectively.

In emerging markets, influenced by leading markets, neighboring regions such as Central and Eastern Europe (e.g. Poland, Ukraine, the Czech Republic, and Romania), Latin America (e.g. Brazil), and Eastern and Southern Africa (e.g. Tanzania) have emerged as new hotspots for the residential energy storage market. This is due to a number of factors, including improvements in safety and stability of energy use and a reduction in electricity costs. Initial development has also been seen in 2024 in residential energy storage markets in Central Asia (e.g. Pakistan and Uzbekistan), Southeast Asia (e.g. the Philippines) and the Middle East (e.g. Iraq, Yemen and Iran), with individual market shipment sizes ranging from 20MWh to 480MWh. These markets are still in the early stages of development, but the potential is significant in terms of power supply, population, GDP, and policies.

Installed capacity of global energy storage market, Infolink

Demand, policy, economy will drive the rise of the residential market in the future

Looking ahead to the development in the coming years, the growth of the residential energy storage market will be driven by a trio of factors such as rigid demand, policy support, and economic efficiency, according to EESA. In the European market, for example, rigid demand is its long-term driver and subsidies are the bottom line of demand.

In 2021, radical clean energy policies have led to the premature withdrawal of Europe's traditional fossil energy generating units from the market, and natural gas dependence on the outside world is as high as 90%; while in the La Niña years, winter temperatures are unusually low, with the unstable supply of clean energy and Europe's energy supply problems, thus the energy crisis is becoming apparent. In 2022, the energy crisis was completely detonated, and the cost of residential electricity soared to a maximum of 0.65 €/kWh. To guarantee the safety, stability, and independence of energy use has become a just need to drive the energy storage market. At the same time, more than 19 countries including Germany, Italy, Austria, Spain, and the United Kingdom, introduced a short-term subsidy policy for household PV and energy storage in order to solve the problem of high energy prices. In 2023, under a series of European initiatives, including limiting maximum tariffs, restarting thermal and nuclear plants, and stockpiling natural gas in advance to secure supply, the cost of electricity in Europe has been brought back to the level of the end of 2021 (0.3 €/kWh), and subsidy policies have started to slow down in many countries, such as Italy.

However, the short-term decline in electricity prices did not help Europe to completely solve the problem of energy security, stability, and independence. Although the short-term explosive growth to a certain extent will overdraw the growth rate of the European household energy storage market in the past two years, in the long term, the development of the European household energy storage market will be driven by rigid demand, carbon neutral policies, short-term subsidies, as well as household PV+Storage annexed buildings.

Year-on-year percent change in electricity demand in selected regions, 2020-2027, IEA

Safer and more efficient energy storage technologies and solutions are needed

Energy storage technology plays a pivotal role in driving the energy storage market. Among the many energy storage technologies available, electrochemical energy storage stands out for its flexibility and adaptability, making it well-suited for various scales and applications. It also boasts scheduling response speed, control accuracy, power system frequency regulation, and construction cycle benefits, positioning it as an irreplaceable and important technology with broad market application prospects. Furthermore, lithium-ion battery technologies, one of the electrochemical energy storage technologies, is distinguished by its superior safety, cycle life, and suitability for different application scenarios, making it a leading contender for the development of electrochemical energy storage technology.

As the household storage market matures, it is witnessing an influx of new participants, including consumer electronics, electric power, and major appliance companies, resulting in confusing market patterns and uneven product quality. Generally speaking, the product form of residential energy storage is developing in the direction of intelligence and high integration that better meets the needs of end-users.

Currently, Dyness owns a comprehensive product portfolio catering to varying user needs in the residential sector, providing powerfulness in all facets of application, design, safety, and user experience. Whether it is market-mature products like Tower and Tower Pro series, or new household solutions such as Powerbox G2 and Powerbrick launched in 2024, Dyness is always moving towards a sustainable future with innovative steps. Under the current market situation, Dyness, as a veteran in the energy storage industry, will continue to enhance its core competitiveness to bring users smarter, more integrated, better performance, and more user-friendly household solutions in 2025, contributing to the promotion of the era of energy interconnection.

PR Contact

Riverego Jiang

Senior Brand Manager

riverego.jiang@dyness-tech.com

Mille Li

Brand Manager

mille.li@dyness-tech.com