The Future of Energy Independence: How C&I Energy Storage is Reshaping Global Industries

-

Company News

-

2025-03-31

-

Dyness

The global energy landscape is undergoing a significant transformation, with commercial and industrial (C&I) energy storage playing a pivotal role. From factories in Spain to office campuses in Greece, businesses are no longer passive consumers of electricity but active participants in a decentralized energy revolution.

From Niche to Necessity: The Explosive Growth of C&I Energy Storage

Imagine a world where factory owners can predict energy prices with the same ease as stock market analysts, and warehouses are transformed into virtual power plants. This vision is becoming a reality at a faster rate than expected. EnergyTrend reported that, only in 2023, the C&I energy storage sector marked a pivotal moment with 4.77GWh of energy storage capacity added, which is creating an ecosystem that connects renewable energy, smart grids, and industrial operations.

The momentum is also accelerating. 2024 is poised to be a watershed year, with installations expected to leap 45% to 11.9 GWh. This growth can be attributed to a confluence of factors, including the significant decline of 80% in lithium-ion battery costs since 2013 (IRENA, 2023), and the ongoing rise in electricity prices in Europe, which is 60% above pre-Ukraine war levels (Eurostat, 2024). In this context, global markets are working to secure energy independence, with Asia-Pacific at the forefront, with 5.3 GWh of new installations in 2024, driven by China's "dual carbon" strategy and Japan's $15 billion green transition fund.

However, the true transformation is just beginning. Analysts predict a 22.5% annual growth rate through 2030, culminating in 50 GWh of annual deployments – enough to displace 25 coal-fired power plants. This trajectory is not merely speculative; it is embedded in policy frameworks such as the U.S. Inflation Reduction Act, which could unlock 150 GWh of storage potential by 2030 through its expansion of the 30% tax credit.

While the numbers paint a compelling picture, the real story lies in how businesses are turning storage from a cost center into a profit engine.

Beyond Backup Power: The New Value Chain of Industrial Energy Storage

Gone are the days when batteries merely provided emergency lighting. Today’s C&I storage systems are sophisticated energy arbitrageurs, grid stabilizers, and carbon accountants. In the Netherlands, the grid overloading and high peak electricity prices brought challenges to business owners. A 215kWh energy storage system of Dyness could offer a reliable power supply and cut operational costs for a club, which has a high demand for electricity consumption during peak hours, pushing the operational economy for its owners.

The value proposition extends far beyond cost savings. In Tenerife Islands, Spain, enterprises and landlords have been seeking renewable technology to face high energy costs and unstable electricity system, as well as to respond to the government's Zero Carbon Emission Target by 2050. Moreover, a Dyness solar plus storage solution allows a local supermarket to increase its solar power use ratio to over 90% from the original 56%.

Policy tailwinds are supercharging adoption. The EU’s REPowerEU plan funnels €300 billion into energy autonomy projects, while China’s latest Five-Year Plan mandates that steel mills and chemical plants install storage equal to 10% of their energy consumption. Perhaps most transformative is the evolving regulatory landscape: in Australia, businesses can now trade stored solar power in energy markets via a virtual power plant system, turning warehouse rooftops into micro-utilities.

The Technology Frontier: Smarter, Safer, and More Adaptive

As financial and policy frameworks continue to evolve, technological advancements are transforming the potential for profitable opportunities. In the competitive marketplace, certain trends are evident that will shape the future of C&I energy storage technology.

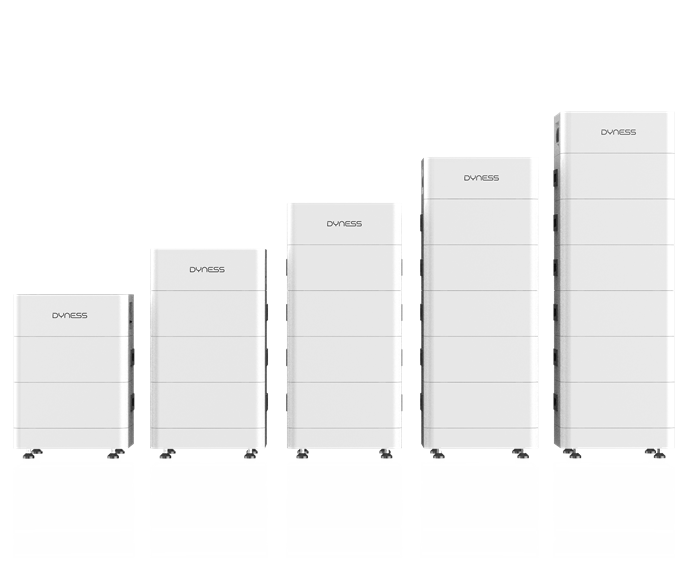

Large-capacity battery cells and system standardization

More and more companies are rolling out 500Ah+ battery cells, reducing per-watt-hour costs by around 20%-30% and boosting energy density to over 180Wh/kg. These advancements simplify system integration and lower upfront investment costs. At the same time, the adoption of modular design could further cut installation time and enable flexible capacity expansion.

Liquid cooling takes over thermal management

With high penetration in C&I scenarios, liquid cooling systems are designed to improve temperature control efficiency, extend system lifespan, and reduce maintenance costs, which is dominating the thermal management of C&I energy storage systems.

LFP dominates battery technologies

Featuring superior safety, cycle life, and suitability for different application scenarios, lithium iron phosphate (LFP) batteries hold a large market share in the C&I sector. Higher requirements for environmental adaptation and usage patterns are also driving further upgrades in LFP technology.

Integration and AI Empowerment

Some companies are developing AI-powered energy management platforms, enabling early warnings for thermal runaways, enhancing fault prediction accuracy, and reducing O&M costs, which provide optimized safety guarantees and energy management accuracy.

Energy Storage with Continuous Innovation Powers Industrial Renaissance

With installations projected to increase by 500% by 2030 and technology costs continuing to decline, C&I energy storage is no longer an option but an imperative. Companies that embrace this transition will reap triple rewards: bulletproof energy budgets, coveted sustainable acceleration, and unprecedented operational agility.

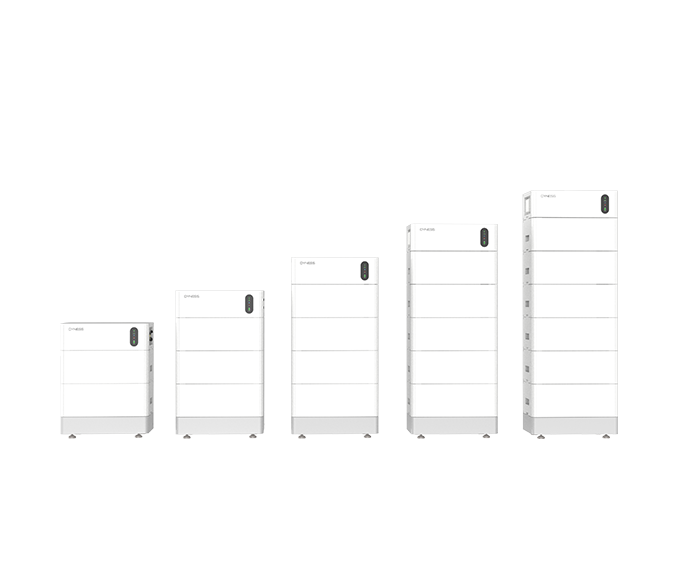

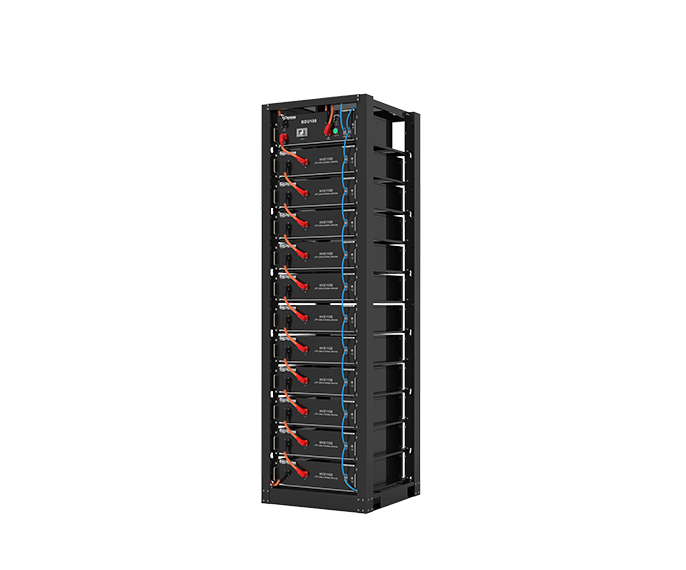

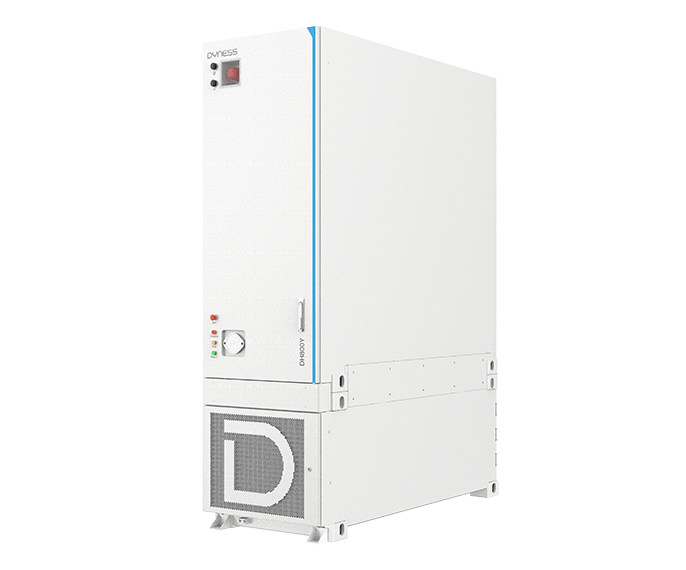

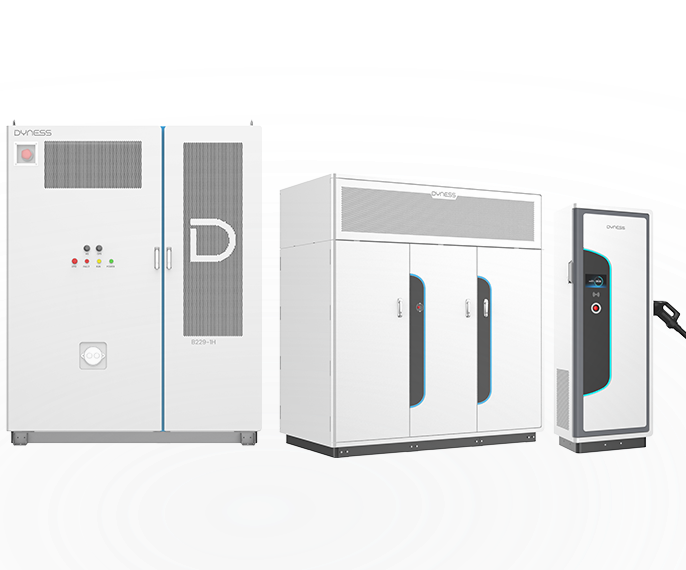

Dyness, the pioneering energy storage innovator, owns a comprehensive product portfolio for C&I scenarios that caters to various usage conditions and energy requirements. From indoor stackable solutions to outdoor all-in-one energy storage cabinets, Dyness C&I energy storage solutions are designed to deliver superior performance across all aspects. With extensive experience in global projects and well-known strengths in solutions, the company is dedicated to promoting sustainable business, with a comprehensive service system and a streamlined marketing process.